On February 19, 2020, Congress enacted the Small Business Reorganization Act of 2019 (“SBRA”), also known as a Sub-Chapter 5 Bankruptcy, to help small businesses through the bankruptcy restructuring process. The intent of the Sub-Chapter 5 Bankruptcy is to provide small businesses with a faster and less expensive option for reorganizing under Chapter 11.

For many years, financially distressed small businesses were unable to utilize Chapter 11 in the same way large businesses could because the process was too expensive, too lengthy, and simply not feasible. The SBRA offers small businesses the same benefits larger debtors receive in a regular Chapter 11 bankruptcy including reducing liabilities, rejecting burdensome leases and executory contracts, eliminating debts, and selling assets but facilitating the bankruptcy process at a lower cost and a faster pace. The SBRA streamlines the plan of reorganization process, enabling small businesses to successfully emerge from bankruptcy with a court-approved plan within 90 days after filing for bankruptcy.

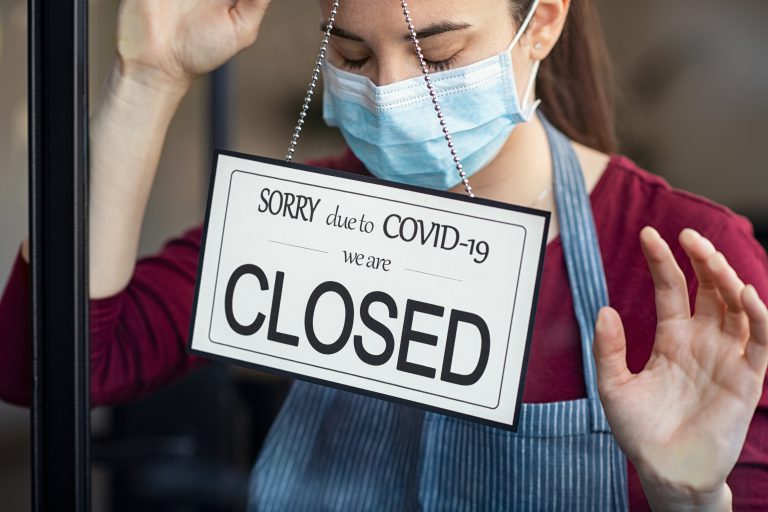

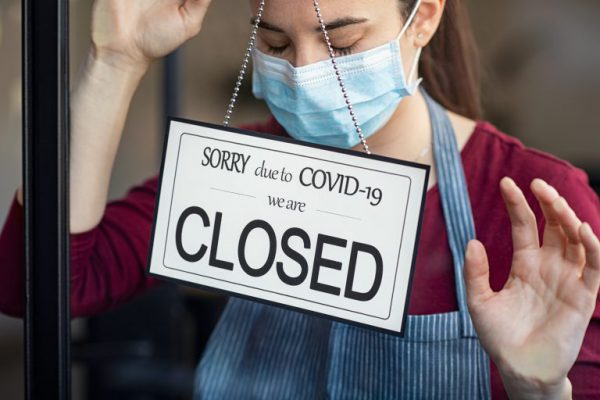

Right as the SBRA went into effect in February, its purpose and potential took on a whole new meaning. No one could have foreseen the pandemic that was about to take an unprecedented toll on the world and the economy. In response to COVID-19, on March 27, 2020, Congress enacted the Coronavirus Aid, Relief and Economic Security Act (“CARES Act”) to provide emergency assistance and health care response for individuals, families and businesses affected by the pandemic. The CARES Act makes some important changes to various provisions of the United States Bankruptcy Code, and, together with the SBRA, provides debt relief for small businesses unlike anything the Bankruptcy Code has provided before.

Here are 10 of the key benefits of Sub-Chapter 5 Bankruptcy:

1) Small Business actually means Small Business

To qualify as a small business debtor, the debtor must be a person or entity engaged in commercial or business activity with total debts (both secured and unsecured) not larger than $7.5 million. There is one exception: a single asset real estate entity, e.g., a debtor who derives substantially all of its gross income from the operation of a single real property, does not qualify under the SBRA. There is no requirement that the small business debtor remain engaged in the commercial or business activity after filing for bankruptcy, but the debtor must show that at least 50% of its pre-petition debts arose from such activities.

2) Increase in Debt Limit

Under the SBRA, a business qualifies as a “small business” if its debts are in the amount of $2,725,625 or less. The CARES Act increased the debt limit from $2,725,625 to $7.5 million, provided that 50% or more of those debts arise from business or commercial activities. This change in the debt limit applies only to cases filed after the CARES Act became effective and is applicable for one year. After one year, the debt limit for cases under Sub-Chapter 5 will return to $2,725,625 absent an extension by Congress.

The increase in the debt limit will substantially increase the number of businesses that are eligible for relief under the SBRA and should benefit not only small business owners, but also their creditors, suppliers, customers, and employees, and, by extension, the overall economy.

3) No Official Committees Required

In a regular Chapter 11 bankruptcy, the U.S. Trustee appoints an official committee of unsecured creditors. If the committee does not like a proposed plan, it will object. This delays the process and often serves as an obstruction to getting a plan of reorganization approved. In a Sub-Chapter 5, a committee does not get automatically appointed but is instead only appointed by order of the court. In small business cases, the appointment of an official committee will be the exception, not the rule. This will also reduce the administrative burden on the small business debtor of having to pay fees and expenses incurred by the committee’s professionals.

4) Change in Professionals

In a regular Chapter 11 bankruptcy, the debtor cannot hire professionals if they hold a pre-petition claim against the bankruptcy estate. The SBRA provides that professionals are not disqualified from employment by a small business debtor if the professional is owed less than $10,000 prior to the date of the bankruptcy filing. This is also helpful for a small business debtor who may not have the funds to provide its bankruptcy counsel with a retainer prior to filing for bankruptcy.

5) Reduction in Administrative Costs and Fees

The SBRA reduces administrative costs and fees for the debtor. For example, small business debtors are exempt from paying U.S. Trustee fees, which are fees based on a company’s disbursements.

6) Appointment of Standing Trustee

In a regular Chapter 11 bankruptcy, a Chapter 11 trustee is appointed only for cause, such as fraud or gross mismanagement, and seizes control of the debtor’s operations. Under Sub-Chapter 5, a “standing trustee” is automatically appointed, but the debtor retains control of its assets and operations. The Sub-Chapter 5 trustee is similar to the trustee in a Chapter 13 individual debtor bankruptcy. The Sub-Chapter 5 trustee’s main role is to facilitate a consensual plan among the debtor and its creditors, similar to a mediator. This may be helpful in reaching a resolution among the debtor and its creditors, and may be particularly useful for a small business whose creditors are unwilling to make reasonable concessions in light of the impending financial crisis.

The trustee will be involved throughout the life of the case, examining and objecting to claims, reviewing the debtor’s financial condition and business operations, appearing at hearings, distributing property per the confirmed plan, and ensuring compliance. Under the supervision of the Department of Justice, approximately 250 Sub-Chapter 5 trustees – mostly attorneys and accountants – were selected out of over 3,000 applicants. Most Sub-Chapter 5 trustees had recently received their first case assignments when the COVID-19 pandemic hit.

7) Only Debtors Can File Plans

In a regular Chapter 11 bankruptcy, any party-in-interest can file a plan once the debtor’s “exclusivity period” has expired. The SBRA authorizes only the small business debtor to file a Chapter 11 plan of reorganization. This is a marked difference that is sure to help the debtor.

8) Streamlined Plan Process and Requirements

Under the SBRA, the plan process is much more streamlined and designed to keep cases moving quickly, which should help conserve administrative costs. A small business debtor must file its plan of reorganization within 90 days after entering bankruptcy unless the court extends this deadline “if the need for the extension is attributable to circumstances for which the debtor should not justly be held accountable.” It seems likely, in the current climate of economic and world health uncertainty, courts are likely to grant extensions liberally.

The SBRA provides for a shortened timeline to file a plan:

- Not later than 60 days after the bankruptcy filing, the bankruptcy court will hold a status conference “to further the expeditious and economical resolution of a case under this subchapter.”

- Not later than 14 days before the status conference, the debtor’s bankruptcy counsel is required to file a report that details the steps the company and its advisors have taken to attain a consensual plan of reorganization.

- Unless the debtor requests an extension related to circumstances outside of its control, the Chapter 11 plan of reorganization must be filed not later than 90 days after the bankruptcy case is filed.

Once the debtor completes all payments according to the plan, the reorganized debtor will receive a discharge from all of its pre-confirmation debts.

Much like a Chapter 13 case for individuals with regular monthly income, Subchapter 5 allows a small business debtor to spread its debt over 3 to 5 years, which benefits both debtors (by allowing them to spread payments over time) and creditors (by allowing them a meaningful recovery from debtors who may not have much money on hand but have a realistic expectation of increased income in the future). A plan of reorganization will generally be confirmed by the bankruptcy court so long as it provides that all projected disposable income of the debtor for 3 to 5 years will be used to make plan payments; or the value of property to be distributed under the 3-5-year plan, beginning on the date on which the first distribution is due, is not less than the projected disposable income of the debtor. In a traditional Chapter 11 case, administrative expenses must be paid at plan confirmation; under Sub-Chapter 5, they may be paid over the life of the plan.

9) Mortgage Modification and Protection

Sub-Chapter 5 makes it harder for creditors to take away a business owner’s residence pledged as collateral to support the business. For example, if the owner of the small business debtor used his or her primary residence as security for a loan to fund the small business, the debtor can seek to modify the mortgage against the primary residence, provided that the mortgage loan was not used to acquire the real property but was used primarily in connection with the debtor’s business.

10) Retention of Equity

The SBRA offers small business owners the opportunity to retain their ownership interest in the reorganized company. In a regular Chapter 11 bankruptcy, generally equity holders will lose their equity in the reorganized company (unless they provide new value to fund a plan of reorganization or the plan provides for payment in full to all unsecured creditors). Under Sub-Chapter 5, the plan may permit the owners of the small business debtor to retain their stake in the reorganized debtor, as long as the plan is “fair and equitable” with respect to each class of claims and interests and does not discriminate unfairly. Additionally, Sub-Chapter 5 eliminates the so-called “new value rule,” which normally requires equity holders to provide “new value” if they want to retain their equity interest in the business.